39+ Mortgage calculator remaining principal

30-Year Fixed Mortgage Principal Loan Amount. Those who pay at least 20 on a home do not require PMI but homebuyers using a conventional mortgage with a loan-to-value LTV above 80 are usually required to pay PMI until the loan balance falls to 78.

Loan Amortization With Microsoft Excel Tvmcalcs Com Amortization Schedule Schedule Templates Schedule Template

With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time.

. The remaining 8 represented other types of mortgage products such as 10-year and 20-year fixed-rate loans. When you take out a mortgage you agree to pay the principal and interest over the life of. Borrowers need to hold this insurance until the loans remaining principal dropped below 80 of the homes original purchase price.

Doing these calculations will give you an idea how much you will spend throughout the life of the loan especially on overall interest cost. This calculator will help you to determine the principal and interest breakdown on any given payment number. Heres how you can manually calculate the interest payment principal payment and balance.

Responsive Mortgage Calculator is an easy to use mortgage calculator for real estate websites. Once the teaser rate expires the loan automatically shifts into a regular amortizing ARM loan. To see the breakdown of each payment or group by them by year and only show how much you will be paying and the balance remaining each.

Remaining P I payments. Loan Balance 5 Years. Equity Built 5 Years.

Your total interest on a 200000 mortgage. Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. The essential part of a mortgage besides the loan amount principal is the interest.

Loan term and downpayment and calculate the monthly payments you can expect to make towards principal and interest. This will be the only land contract calculator that you will ever need whether you want to calculate payments for residential or commercial lands. The first payment would be split into 27500 of interest and 13773 of principal.

Early Mortgage Payoff Calculator. Enter additional payments view graphs calculate CMHC rates interest and mortgage payments. To show you how this works lets compare two 30-year fixed mortgages with the same variables.

Loan Balance 10 Years. Loan Balance 15 Years. Most closed mortgage products allow a once-per-year lump sum payment of up to 20 of the remaining principal amount or balance.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. We used the calculator on top the determine the results. A general rule-of-thumb is that the higher the.

Thats about two-thirds of what you borrowed in interest. Ultimately how much you need to make depends on your down payment loan terms taxes and insurance. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage.

Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D. Compare and see which option is better for you after interest fees and rates. If your balance at the end of the year is 100000 the.

You can choose to make an extra payment towards the principal. Get 247 customer support help when you place a homework help service order with us. There are balloon mortgages which refinance the remaining.

See how your monthly payment changes by making updates to. Interest Rate APR 3528. Equity Built 10 Years.

Monthly Principal Interest. Deduction for charitable contributions. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year.

Simply enter the original loan term how many years you have remaining on the loan the original mortgage amount the interest rate charged on the loan the amount you would like to add as an extra payment to each monthly payment. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other. A Note on Private Mortgage Insurance.

Additional payments of 50 to 100 a month have the most impact during the early years of a loan. For example a 51 IO ARM would charge interest-only for the first 5 years of the loan then at that point the loan would convert into an amortizing loan where the remaining principal is paid off over the subsequent 25 remaining years of the loan. The loan is secured on the borrowers property through a process.

It comes with a sidebar widget and shortcode that you can use inside your WordPress posts pages and below your listings. Remaining P I payments. See the monthly cost on a 250000 mortgage over 15- or 30-years.

It can also handle. Our mortgage calculator supports four types of extra payments. Our Canadian Mortgage Calculator allows you to calculate your monthly mortgage payments and cash needed for the purchase of real estate using current lender rates.

Just follow the formulas and use the example below. After putting in just a few digits you will find out what your monthly payment and total payments will be. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Enter the loans original terms principal interest rate number of payments and monthly payment amount and well show how much of your current payment is applied to principal and interest. Equity Built 15 Years. This can be done by making extra mortgage payments toward your principal.

Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. 15 2017 have this lowered to the first 750000 of the mortgage. Use SmartAssets free Pennsylvania mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more.

Mortgage calculator is a simple tool that helps you estimate the cost of your mortgage. 15 Year Fixed Rate Mortgage Calculator. This calculator will compute a mortgages monthly payment amount based on the principal amount borrowed the length of the loan and the annual interest rate.

So with a 20 down payment on a 30-year mortgage and a 4 interest rate youd need to make at least 90000 a year before tax. Mortgage Type 25-YR FRM 30-YR FRM. Homes purchased after Dec.

Land Transfer Tax LTT 28473. By the end of the mortgage term in the year 2033 by contrast the interest payment would be only 1. Interest paid on the mortgages of up to two homes with it being limited to your first 1 million of debt.

On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage. It shows a graph for the principal interest and remaining balance across the term of the mortgage.

Remaining Mortgage Balance. Deduction for medical expenses that exceed 75 of AGI. Deduction for mortgage interest paid.

PMI typically costs from 035 to 078 of the loan balance per year.

What Is A Mortgage Preapproval Ally Preapproval Mortgage Infographic Mortgage

Tbd Bear Paw Trail Almont Co 81210 Compass

Amp Pinterest In Action In 2022 Amortization Chart Amortization Schedule Mortgage Amortization Calculator

Flat Interest Rate Vs Reducing Balance Rate Types Of Loans Interest Rates Interest Calculator

Too Much Words Too Much Words Too Much Words The Audience Would Not Easily Pay Attention To Print Ads How To Play Dominoes Mortgage Amortization Calculator

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

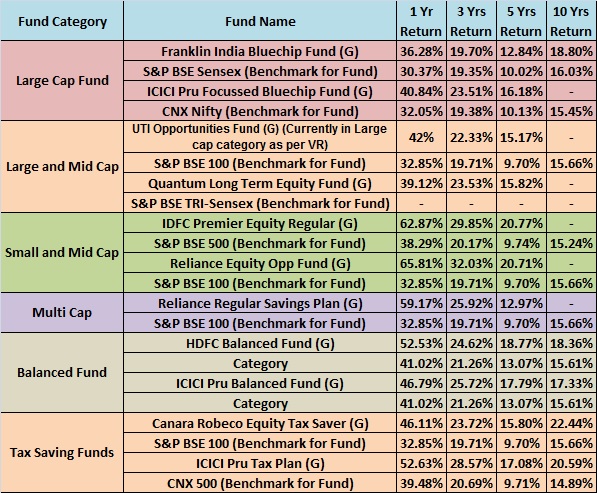

Top 10 Best Mutual Funds To Invest In India For 2015

Amortization Schedule Amortization Schedule Car Loan Calculator Mortgage Amortization Calculator

Printable Mortgage Calculator In Microsoft Excel Mortgage Loan Calculator Mortgage Amortization Calculator Refinancing Mortgage

Infographics Keeping Current Matters Mortgage Interest Rates Mortgage Rates Mortgage

Installment Loan Payoff Calculator In 2022 Loan Calculator Mortgage Amortization Calculator Amortization Schedule

How Can You Efficiently Use Hdfc Personal Loan Calculator Personal Loans Amortization Schedule Loan Calculator

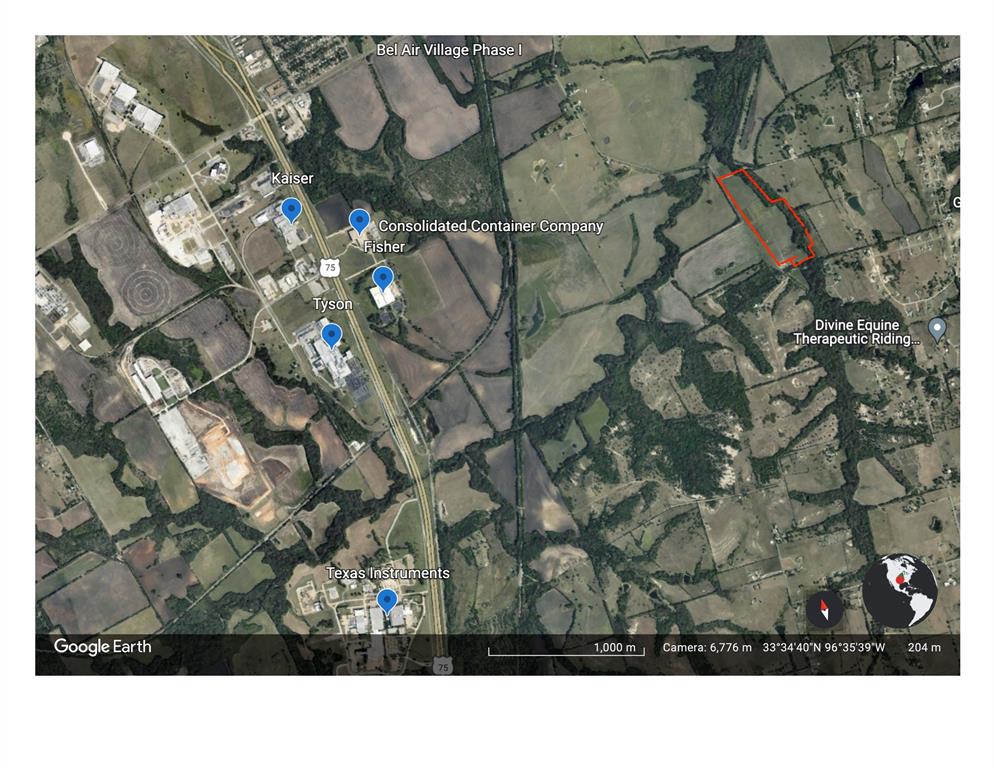

39 92 Ac Luella Road Sherman Tx 75090 Compass

55 Xxx West Indian School Road Tonopah Az 85354 Compass

55 Xxx West Indian School Road Tonopah Az 85354 Compass

Neath The Wind Realty

4615 Hall Road Santa Rosa Ca 95401 Compass